The Implications of Active Pharmaceutical Ingredient (API) Imports from China

In recent years, the global pharmaceutical landscape has undergone significant transformation, with China's role becoming increasingly prominent

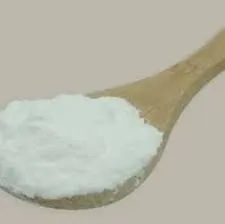

. One of the key components of this shift is the importation of Active Pharmaceutical Ingredients (APIs) from China, which has become a focal point for discussions surrounding drug quality, supply chain reliability, and national regulations.APIs are the crucial elements of any pharmaceutical product, responsible for its therapeutic effects. As such, the sourcing of high-quality APIs is paramount for pharmaceutical manufacturers. China's emergence as a leading supplier of APIs can be attributed to its vast manufacturing capacity, cost advantages, and a well-established infrastructure. The country houses numerous API manufacturers, many of whom have invested in modern production techniques and comply with international standards.

However, the reliance on Chinese API imports is multifaceted and presents both opportunities and challenges for the global pharmaceutical industry. On the one hand, the low production costs associated with Chinese manufacturing provide a significant competitive edge. Companies can reduce their operational expenses, which in turn can lead to lower prices for consumers. This economic benefit has been a driving force behind many pharmaceutical firms choosing to source APIs from China, aiming to sustain profitability and meet market demands.

On the other hand, there are heightened concerns regarding the quality and safety of these imported ingredients. There have been instances of contamination and substandard products originating from Chinese factories, leading to recalls and safety warnings in various markets. Regulatory agencies across the globe, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), have implemented stricter measures to oversee the import of APIs. These regulations aim to ensure that imported APIs meet rigorous quality standards and are safe for consumer use.

active pharmaceutical ingredient import from china

Moreover, the COVID-19 pandemic further exemplified the vulnerabilities inherent in the pharmaceutical supply chain. The pandemic triggered disruptions in production and logistics, revealing an overreliance on a limited number of suppliers, particularly in China. This situation prompted many pharmaceutical companies to reconsider their supply strategies and explore diversification. Some firms are now investing in domestic production capabilities or seeking alternative suppliers in different countries to mitigate risks associated with potential future supply chain disruptions.

The geopolitical landscape also plays a crucial role in shaping the dynamics of API imports from China. Trade tensions and tariff disputes between major economies, such as the United States and China, have led to increased uncertainty in the market. The imposition of tariffs on Chinese goods has the potential to inflate costs for pharmaceutical companies reliant on Chinese APIs. Consequently, companies may be compelled to rethink their sourcing strategies, leading to shifts in the global supply chain.

Furthermore, the growing emphasis on sustainability and ethical sourcing is influencing the way companies perceive API imports from China. With increased awareness around environmental and social governance (ESG) issues, pharmaceutical manufacturers are under pressure to ensure that their supply chains uphold ethical practices. This trend may drive some companies to pursue more sustainable sourcing practices, including looking for suppliers who adhere to environmentally-friendly manufacturing processes.

In conclusion, the import of Active Pharmaceutical Ingredients from China is a complex issue that embodies both significant advantages and considerable challenges for the global pharmaceutical industry. While cost efficiency and manufacturing capacity present undeniable benefits, concerns about quality, safety, supply chain vulnerabilities, and geopolitical factors necessitate a cautious approach. As the pharmaceutical landscape continues to evolve, companies will need to strike a balance between cost-effectiveness and sustainability, ensuring that they not only meet market demands but also prioritize the health and safety of consumers. The path forward will likely involve diversification of suppliers, investments in quality assurance, and a commitment to ethical and sustainable practices, shaping the future of pharmaceutical ingredients and their role in global health.