Plastics Additives

Plastics additives are essential for the proper functioning and continuity of plastic articles. These plastic articles are used in the automotive, aviation and railroad industries, construction, electrical/electronics industry, appliances, packaging materials, communications technology and healthcare/medical applications, among others.

Eight functional classes of specialty plastics additives are described in this S&P Global report: antioxidants, antistatic agents, chemical blowing agents, flame retardants, heat stabilizers, impact modifiers, light stabilizers and lubricants/slip additives. (This definition excludes an important additive group, plasticizers. However, these additives can be classified as commodities.) Although the growth in plastics additives consumption parallels consumption growth in plastic resins, some plastics additives consumption rates are growing more rapidly than others. Demand for plastics additives is strongly dependent on production and consumption of plastics, in general, but is also influenced by demand from plastics end-use consumer segments and changes in government regulations.

6-Amino-1,3-dimethyluracil

Plastics end-use industries such as automotive, aviation, electronics, medical and construction often demand high-performance, safe and/or eco-friendly plastics additives, reflecting the high-quality requirements for advanced plastics applications with environmentally safe properties. Responding to growing demand from end-use industries, the global plastics additives market has been growing, although there have been fluctuations and downturns driven by economic and global conditions.

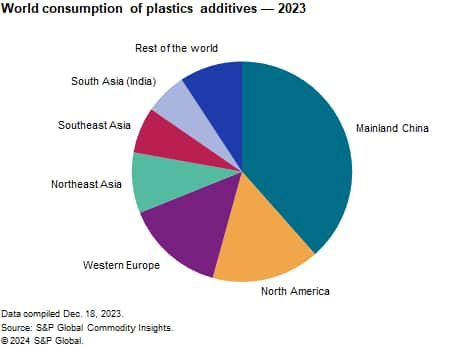

The following pie chart shows world consumption of plastics additives:

Asian plastics additive markets were the largest in 2023, followed by North America and Western Europe. Mainland China is the world’s largest plastics additive market, accounting for close to 40% of the global market, on a volume basis. The plastics additive markets in India and ASEAN countries are expected to continue to expand at a faster rate (in comparison with other countries) during 2023–28. This is owing to the growing manufacturing industries in these markets.

For more detailed information, see the table of contents, shown below.

S&P Global’s Specialty Chemicals Update Program – Plastics Additives is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program – Plastics Additives has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations and other factors on chemical profitability